According to Amazon, many retailers have started closing their Vendor Central entries. Some people have reported that they have received messages from Amazon saying they will no longer buy from these retailers as of November 9, 2024.

What is Vendor Central?

Vendor Central is Amazon’s 1st party (1P) platform where Amazon buys directly from brands and sellers, taking full ownership of inventory. Unlike third-party (3P) Amazon FBA accounts, where sellers always own their inventory and Amazon only acts as a marketplace.

For more information, read our in-depth post on Vendor Central.

What does Amazon do with Vendor Central accounts?

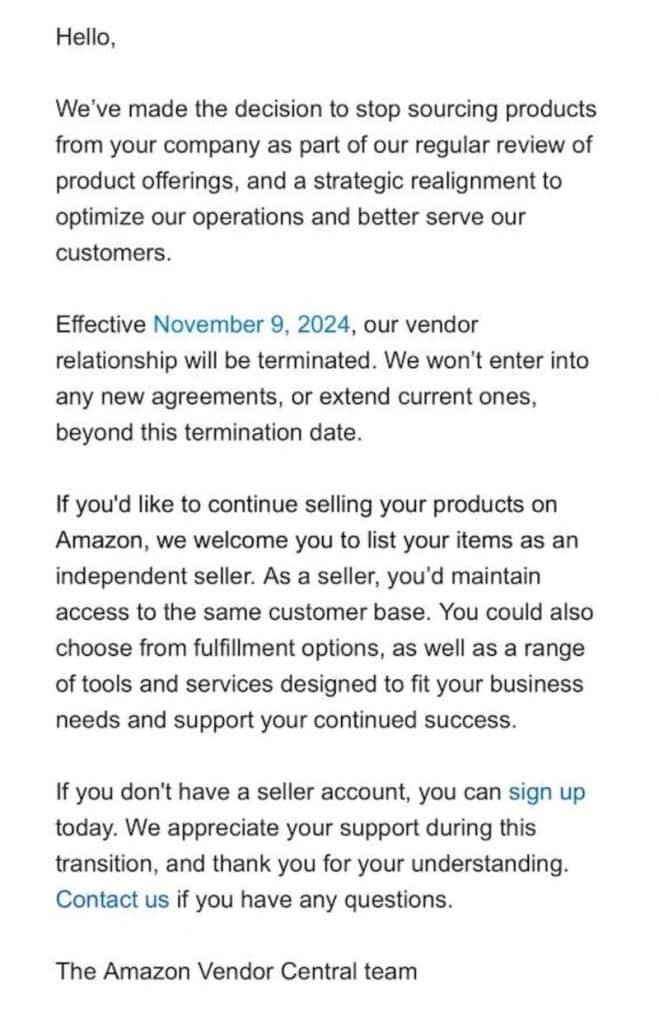

Just as Amazon can close Seller Central accounts in the event of a policy violation, it does not deactivate Vendor Central entries. Sellers on Vendor Central will retain access to their accounts, but Amazon “…]will no longer enter into new agreements or renew existing agreements after this termination date.”

Below is a version of the Amazon notice that many retailers received.

Essentially, Amazon is stopping issuing new purchase orders to various VC customers.

It is unclear how this affected some VC sellers

The actual number of VC buyers affected by this shift remains unknown, though it appears to be very large. A frequently visited LinkedIn Amazon Vendor Central class is one of many platforms where this topic has generated a lot of discussion.

The cancellation will likely affect both small, minor and major corporate brands, as it could lead to significant supply shortages of some of the best consumer products on the market.

Why is Amazon discontinuing centralized agreements with suppliers?

The actual reason for Amazon’s decision to terminate contracts remains unclear, but it appears to be a deliberate and intentional tactical move. Possible theories include:

- Seller Central dealers are less profitable than third-party FBA sellers, so Amazon is targeting smaller VC sellers in Seller Central.

- The company seems to favor corporate-level businesses over smaller ones.

- In a sluggish economy, Amazon may be trying to reduce the risks associated with ownership.

- Amazon may try to reduce the number of accounts in its Vendor Central software, which has been abused in the past to control listings.

- The move could strategically improve Amazon’s revenue presentation to shareholders, with timing being a critical factor (see below).

Profitability is usually the main factor in these decisions: Amazon intends to move VC sellers out of FBA and considers 3P accounts more profitable than 1P accounts. Third-party retailers handle logistics, advertising, and marketing themselves, whereas with first-party accounts, those responsibilities are typically shifted to Amazon.

When Amazon acts as the owner of products, it assumes ownership of those products. Thus, Amazon is exposed to significant inventory dangers, especially during periods of possible economic downturn. This choice can show Amazon’s efforts to mitigate the risks associated with extreme inventory.

In addition, Vendor Central accounts have typically been used to exploit loopholes in Amazon’s software, particularly to change product advertisements. Due to the ability to modify both their own and other people’s products, Vendor Central accounts are very popular in the marketplace. While Amazon’s goal may not be the most important, limiting the number of VC records is a positive side effect.

The implications of terminating key vendor agreements are discussed in the financial report.

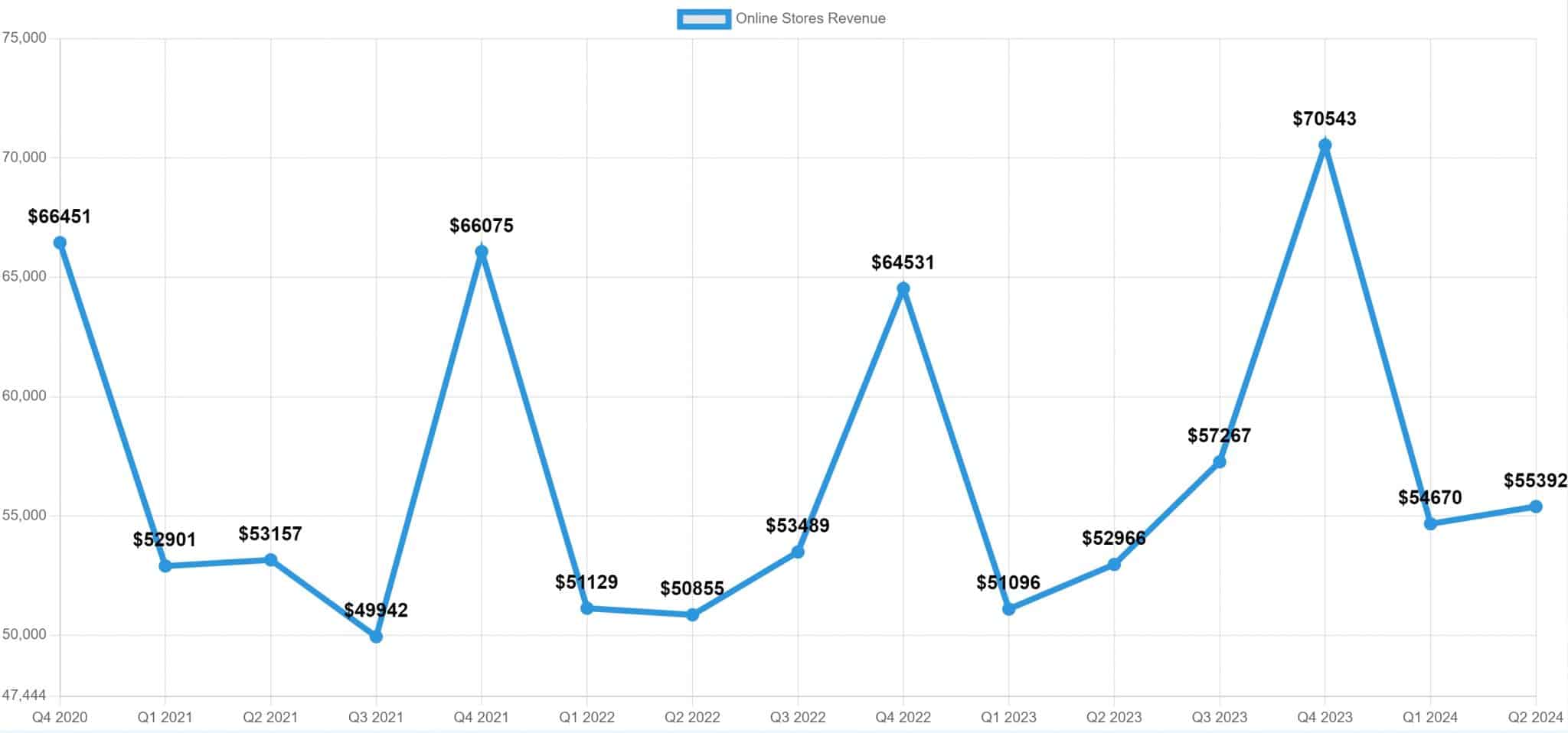

It should be noted that Amazon’s decision to eliminate multiple Vendor Central accounts will have a significant impact on revenue growth. This is due to the way Amazon reports financials: for 1P sellers (Vendor Central), gross revenue is recognized, while for 3P sellers (FBA), only service fees are recognized. Simply put, if Amazon sells a $100 vacuum cleaner through Vendor Central, it reflects $100 in sales, while for 3P sales through FBA, only the earned commission (typically 20-50% of the sale price) is reflected.

The result of the study will likely result in a decrease in “Amazon Online Store Revenue”, but “Seller Service Commission” revenue is expected to increase (though probably not enough to offset the decrease in revenue). While this change will have a positive impact on overall success, it could negatively impact revenue growth. Investors are likely to take these results seriously in a market where earnings are prioritized over growth.

For a detailed analysis of Amazon’s real estate historical performance in recent years, please see our full research.

Conclusion

The abrupt termination of the contract with Vendor Central will cause significant problems for those using the program. We switched from Vendor Central to Seller Central in 2015, and it had a significant impact on both our multi-month success and revenue growth. However, gaining more control over our records over time has proven beneficial to our company, and we hope this is also true for existing Vendor Central sellers.

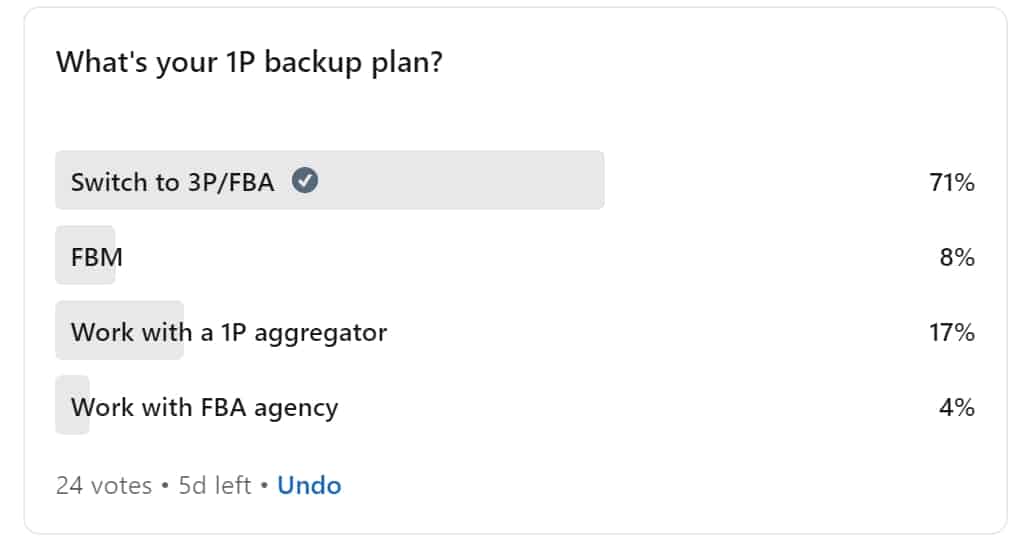

Do you know if Amazon has informed you that it will no longer be able to sell your items through Vendor Central? If so, are you considering switching to Amazon FBA or leaving completely? Share your thoughts in the reviews section above.